Ralph Lauren Tops Q1 Earnings Estimates

Updated Aug. 10, 11:50 a.m.

More from WWD

While Tapestry Inc. promises to change the face of the American fashion landscape with its $8.5 billion deal to buy Capri Holdings, Ralph Lauren Corp. has already changed — and likes its position very much.

Just as the market was digesting news of the mega takeover, Ralph Lauren weighed in with first-quarter results that showed the company was continuing its long quest to elevate its image and to raise prices. The company raised its average unit retail prices 15 percent across its direct-to-consumer network, on top of an 8 percent gain a year ago.

That higher-end focus and strength in Europe and Asia helped the company blunt the impact of weakness in its home market and topped earnings estimates for the quarter.

“If you step back big time, we really reset the foundations of our brand,” said Patrice Louvet, president and chief executive officer, in an interview with WWD. “This isn’t just one quarter or two, this is years of work to really deliberately elevate every facet of the consumer experience. We remain on offense.”

With a lifestyle positioning, the brand has a broad enough base to quickly catch market trends. For instance, the CEO said it was “sophisticated casual” looks that are selling now, from Oxford shirts to dresses. “Where there is more pressure is on kind of the ‘COVID[-19]’ categories, if I can call them that, think T-shirts, fleece and shorts.”

The point is, Ralph Lauren has both and can be where the market is going, or catch up quick.

“We have built in flexibility because the environment remains dynamic,” Louvet said. “The word for us is…resilient.”

And the changes in the market promise to keep coming fast — witness the Tapestry-Capri deal.

“It’s an interesting move,” Louvet said when asked about the acquisition. “As with all these moves and with everything in our industry, it’s ultimately all about execution.”

Louvet said there was not tons of direct competition between Ralph Lauren and the Tapestry and Capri brands, which include Coach, Kate Spade, Stuart Weitzman, Michael Kors, Versace and Jimmy Choo.

Those brands are more focused on handbags and shoes whereas Ralph Lauren is heavier in apparel.

“We have limited overlap with this new combination of brands,” Louvet said. “Limited overlap both from a category standpoint and from a price tier standpoint.”

For the first quarter, Ralph Lauren’s net income increased 7 percent to $132.1 million, or $1.96 a diluted share, from $123.4 million, or $1.73 a year earlier. Adjusted earnings per share, which exclude restructuring-related charges, came in at $2.34 — 20 cents better than the $2.14 analysts projected, according to FactSet.

Revenues for the three months ended July 1 inched up to $1.5 billion from $1.49 billion a year earlier, an increase of 1 percent in constant currencies that was led by Europe and Asia. Analysts were expecting a slight decline in sales.

Still, the company’s push to elevate its brand hasn’t insulated it from the economy and the brand still has a more value oriented customer in part of its business that is feeling the pinch of inflation.

Revenues in North America fell 10 percent to $632 million, with about half of that coming from a shift of spring receipts into the fourth quarter of last year as the company normalized its timing post pandemic.

The company’s own comparable store sales in North America fell 6 percent, including an 8 percent drop in digital commerce and a 5 percent decrease in brick-and-mortar doors.

Wholesale sales in the market fell 16 percent and would have been down by midsingle digits without the timing shift.

“We are working with our wholesale partners to activate traffic and conversion and, within the outlet channel it’s a combination of really shaping our product offering and assortment in a way that’s really going to resonate with the customer,” Louvet said.

Revenues in Europe rose 8 percent to $450 million while Asia increased 13 percent to $378 million.

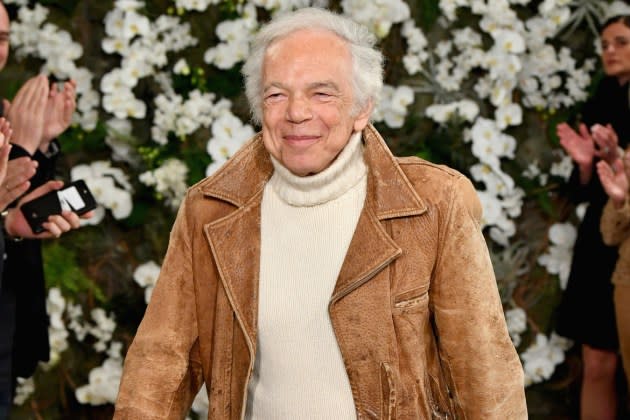

Ralph Lauren, executive chairman and chief creative officer, added: “What we do is about the connection between the beauty of an authentic life and the elegance of timeless style. This underlies everything we create at our company — from our elevated presentation at Wimbledon and in our new Miami Design District store to our beautiful California Dreaming events across Europe and Asia — as we inspire people around the world to step into their dreams.”

Best of WWD