Former Crypto Billionaire and FTX Founder Sam Bankman-Fried Found Guilty of All Seven Fraud Charges

The once high-flying CEO faces 115 years in prison after being found guilty of defrauding customers on his failed digital currency exchange, FTX

Failed cryptocurrency billionaire and FTX founder Sam Bankman-Fried was found guilty of federal fraud and other charges on Thursday.

Jurors decided the fate of the disgraced crypto financier, 31, finding him guilty of wire fraud, securities fraud and money laundering after defrauding customers on his FTX crypto exchange and lenders to his investment firm, Alameda Research, say prosecutors.

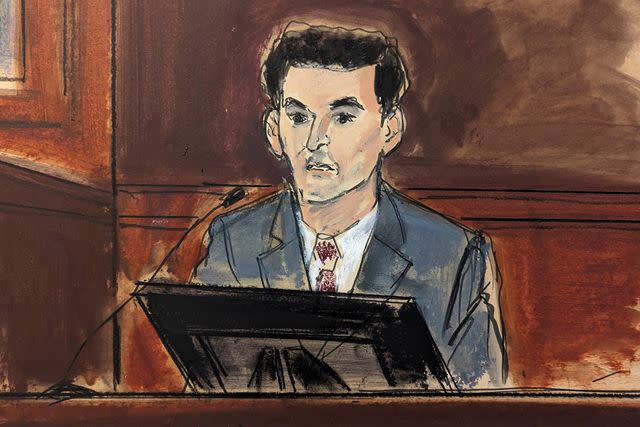

Elizabeth Williams via AP

Courtroom sketch of Sam Bankman-Fried“Bankman-Fried maintains his innocence and will continue to vigorously fight the charges against him,” his attorney Mark Cohen said, per CNN.

Judge Lewis Kaplan set his sentencing hearing for March 28.

During the trial, which began with jury selection on Oct. 3, jurors heard from a slew of witnesses including three top executives Gary Wang, Nishad Singh and Caroline Ellison, who were also Bankman-Fried’s close friends.

Ellison, Alameda’s former CEO, was his ex-girlfriend.

Bankman-Fried and his colleagues worked together and in some cases, lived together in a lavish, $30 million penthouse in Nassau, Bahamas, where FTX was located.

Ellison pleaded guilty to federal charges and agreed to cooperate with prosecutors, ABC News reported.

Related: Sam Bankman-Fried’s Ex-Girlfriend Testifies that FTX Founder 'Directed' Her to Commit Crimes

In bombshell testimony, she told the court that her ex-boyfriend told her to commit fraud, according to multiple outlets including NBC News.

“Sam directed me to commit these crimes,” she said in her testimony, alleging that Bankman-Fried asked her to funnel money from his customers at now-defunct crypto exchange FTX into Alameda in order to pay back firms that Alameda had borrowed from, the outlet reports.

“We ultimately took around $14 billion, some of which we were able to pay back,” she said, according to CNBC. “I sent balance sheets to lenders at the direction of Sam that incorrectly stated Alameda’s assets and liabilities.”

AP Photo/Bebeto Matthews

Sam Bankman-FriedShe also alleged that Bankman-Fried designed a way for her to transfer the funds, CNBC and NBC News report. She said he was “very ambitious” and that he thought he had a 5% chance of someday becoming the president of the United States, according to the Associated Press.

Arrested on Dec. 12, 2022, in Nassau, the former CEO pleaded not guilty to 13 charges, including fraud and bribery.

In December 2022, he was released on a $250 million bond and ordered to stay at his parents’ home in Palo Alto, Calif. His bond was revoked in August 2023 for alleged witness tampering. He was then remanded to the custody of U.S. Marshals and then to jail, ABC News reported.

Bankman-Fried’s dizzying fall from grace came after authorities began investigating his company in 2022 after it sought bankruptcy protection for losing billions of dollars in a short amount of time.

Calling the case "one of the biggest financial frauds in American history,” Damian Williams, U.S. Attorney for the Southern District of New York, which charged Bankman-Fried said in 2022, said, "From 2019 until earlier this year, Bankman-Fried and his co-conspirators stole billions of dollars from FTX customers. He used that money for his personal benefit, including to make personal investments and to cover expenses and debts of his hedge fund, Alameda Research," CNN reports.

Before his arrest, Bankman-Fried was named "one of the richest people in crypto" by Forbes.

Want to keep up with the latest crime coverage? Sign up for PEOPLE's free True Crime newsletter for breaking crime news, ongoing trial coverage and details of intriguing unsolved cases.

At the height of its success, his company was valued at $40 billion, according to FTX lawyers, NPR reports.

Bankman-Fried co-founded Alameda Research in 2017, three years after graduating from MIT with a degree in physics. Two years later, Bankman-Fried started FTX.

Authorities allege that Bankman-Fried used customer funds from FTX to save Alameda without telling investors.

"U.S. prosecutors said Bankman-Fried had engaged in a scheme to defraud FTX's customers by misappropriating their deposits to pay for Alameda's expenses and debts and to make investments," Reuters reported.

He defrauded lenders to Alameda “by providing them with false and misleading information about the hedge fund's condition, and sought to disguise the money he had earned from committing wire fraud," prosecutors said, per Reuters.

His attorneys did not immediately respond to PEOPLE’s request for comment.

For more People news, make sure to sign up for our newsletter!

Read the original article on People.