Predictive Analytics Firm FindMine Raises $8.2 Million

FindMine recently raised $8.2 million in its seed round, as fashion brands continue to try to predict the future.

The predictive intelligence and analytic firm’s latest fundraising round was led by investment firms XSeed Capital and Underscore VC and is on top of $1.7 million already raised, bringing FindMine’s total investments to $9.9 million.

More from WWD

“We’re excited about this investment because it means that we can continue to grow our platform’s ability to create highly-produced and differentiated editorial content out of thin air, empowering brands and retailers to maintain visibility with customers and other key audiences while driving both revenue and loyalty,” said Michelle Bacharach, chief executive officer of FindMine.

The company uses predictive intelligence and merchant sales data to help brands predict trends and manage inventory levels. The firm also creates content for a number of beauty, apparel and home brands — such as Adidas, Perry Ellis, Reebok and Cole Haan, among others — across company websites, campaigns, social media, emails and in stores.

FineMine’s latest funding round comes as many retailers in the online personal styling industry are struggling with how to retain customers and turn a profit in the era of uncertainty. Stitch Fix, perhaps the leader in the space, slashed 15 percent of its corporate workforce in its most recent quarter after widening its losses. Nordstrom said in May that it was winding down its personalized styling service Trunk Club, which it acquired in 2014. Instead, Nordstrom said it would concentrate its efforts on in-house personal styling services. Other brands simply can’t keep pace with rapidly-changing consumer demands and content creation.

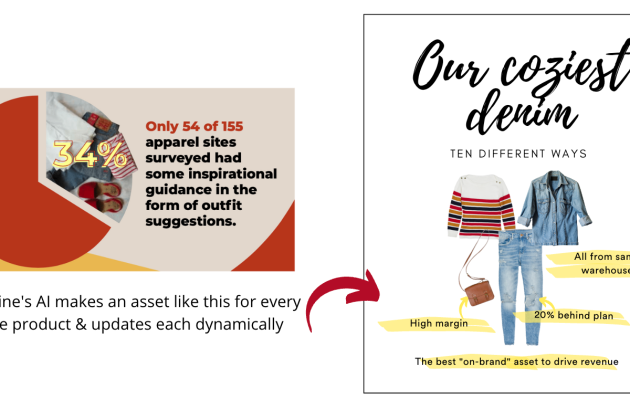

Bacharach acknowledged that “the current personalization process is broken and one-to-one, personal-based marketing simply does not scale because the industry forgot about one big piece of the equation: the content,” explaining that this model “puts the onus on the brand to come up with the content, resulting in the same small amount of assets sent to every consumer [and] segment. Marketing teams cannot create bespoke curated editorial content for each and every consumer. This is why we’re changing the game with [artificial-intelligence] powered automation that can create visual, shoppable assets in milliseconds.

“FindMine’s technology allows marketers to showcase unique, curated shoppable assets to every single segment and customer to improve top-line revenue with larger shopping carts and longer, more profitable customer lifecycles,” she continued. “Merchants use FindMine to improve bottom-line profitability and increase gross margins thanks to more effective inventory and logistics management.”

The latest investment round will be used to accelerate go-to-market activities and further develop the firm’s AI-powered content engine and machine learning technology. New data sets will also be used to locate inventory along the supply chain and reduce split shipments.

“FindMine is the next rock star company in the retail tech space, thanks to their ability to help brands connect with customers at scale,” said Underscore VC partner Lily Lyman

Damon Cronkey, partner at XSeed Capital, added that the current retail landscape has never been more competitive. “And FindMine has proven that they understand how to solve one of the most challenging issues in online marketing, which is creating a large volume of relevant content that drives purchasing behavior and leads to long-term success. By leveraging AI and their deep experience with top brands, FindMine is poised to become the leader in an exciting and incredibly large new market.”