Why it's the best time to be a female boss in the UK right now

It is a depressing truth that fewer than half of young people are able to list an entrepreneur who inspires them. Of those who can, 85 per cent will name a man – most commonly Lord Sugar or Sir Richard Branson. How unfortunate that the female tech entrepreneur currently consuming most column inches is doing so not for business acumen, but for an alleged dalliance with our Prime Minister.

But change is afoot. A new report by the Female Founders Forum, a joint Entrepreneurs Network/Barclays project, has found that the share of funding to women-led firms has doubled in less than a decade. In 2011, just 11 per cent of startups that raised investment were female founded. By 2018, the figure had nearly doubled to 21 per cent. The total amount invested in businesses with at least one female founder in 2018, as a percentage, was 11.4 per cent, up from 9.9 per cent in 2017.

The report, entitled Here and Now: Making the UK the Best Place in the World for Female Founders, also busts the myth that female led companies are a less bankable investment. Once they received an initial investment, female-founded startups were just as likely to raise additional rounds of funding compared to non-female-founded firms (52% vs 51%). Among startups five or more years on from their first investment, female founded startups are even more likely to secure second funding round (66.5% vs 62.8%).

This makes sense: at the early stages where venture capital firms make their initial investments, there is limited rigorous, objective information available. It means the founding team comes under great scrutiny, and there is a risk that gender bias can play a make-or-break role in who receives investment. As investors get more information, however, unconscious bias is less decisive.

This is just the start for women in a nation that sees girls doing better at school and more likely than their male peers to get to university, though they still come up against myriad barriers once they make it to the workplace. And in no field have the statistics been so historically bleak as entrepreneurship. The story today may be positive but women still run just one in five businesses and studies show that a female voice, name or picture decreases the likelihood of achieving investment.

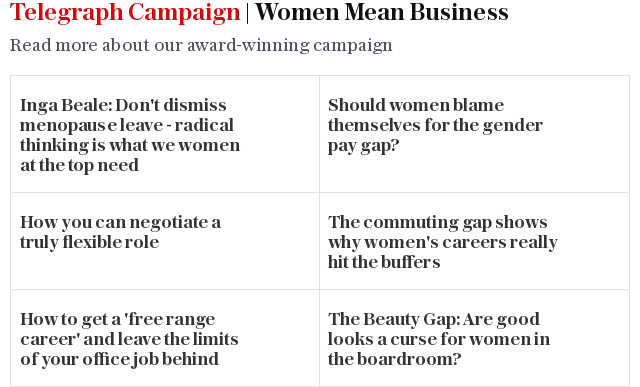

Members of the Female Founders Forum – the foremost group of UK female entrepreneurs – have told of venture capitalists asking what their husbands make of the business, or querying “who will look after the children”. It’s why two years ago the Telegraph launched the Women Mean Business campaign which shines a light on the gender funding gap. The willing is there, if the way is not (yet).

The campaign has time and again demonstrated that when women feel as comfortable, confident and inspired as men – and get the funding to match – they launch great businesses. HM Treasury in March published the Rose Review into Female Entrepreneurship, which found that if we can create an environment where women start and scale businesses at the same rate as men, it could represent a £250bn opportunity for the UK economy. Politicians, journalists, key figures from within the finance industry and entrepreneurs themselves have sat up and taken note.

A cornerstone of the Review is the Investing in Women Code, which aims to improve female entrepreneurs’ access to tools, resources and finance from the financial services sector. Crucially, most of the big banks have become signatories to the Code and have pledged to provide HM Treasury with data on businesses broken down by gender. Female venture capitalist (VC) partners are three times more likely to invest in companies with a female CEO, but Diversity VC has revealed that 83% of VC firms have no women on their investment committees.

Tackling unconscious bias, perhaps through training programmes, is key to the solution. As female founder Tugce Bulut says, “We need to teach kids entrepreneurial skills from the start. I cannot stress enough how important it is to learn how to take risks and cope with failure.” Bulut’s AI market research company has raised over £20m and is one of the UK’s fastest-growing firms. She is right that schools need to instil the right skills, financial literacy and self-belief in young girls so they may become the entrepreneurs of the future.

There is more to do. A lot more. We must continue to highlight the challenges still faced by female entrepreneurs, but these new figures show we are on the right course. Only by celebrating how far we’ve come can we inspire the next generation.

Annabel Denham is Head of the Female Founders Forum

Network with other female founders and hear inspiring talks by amazing female business leaders from Tina Brown to Samantha Cameron at this years Women Mean Business Live event - details below

--