Where Fashion Falls in Consumer Spending

Fashion spending gained year-over-year, but so did plants, travel and housing.

Watch out for the philodendron, the daisies and the roulette table, too — consumers have a lot of places to put their money.

More from WWD

The economy has been much stronger than most dared to hope heading into 2023, but fashion is still only getting a sliver of the consumer spending increases, which have been both solid and driven largely by the inflation that’s been working its way through the system in the wake of the pandemic.

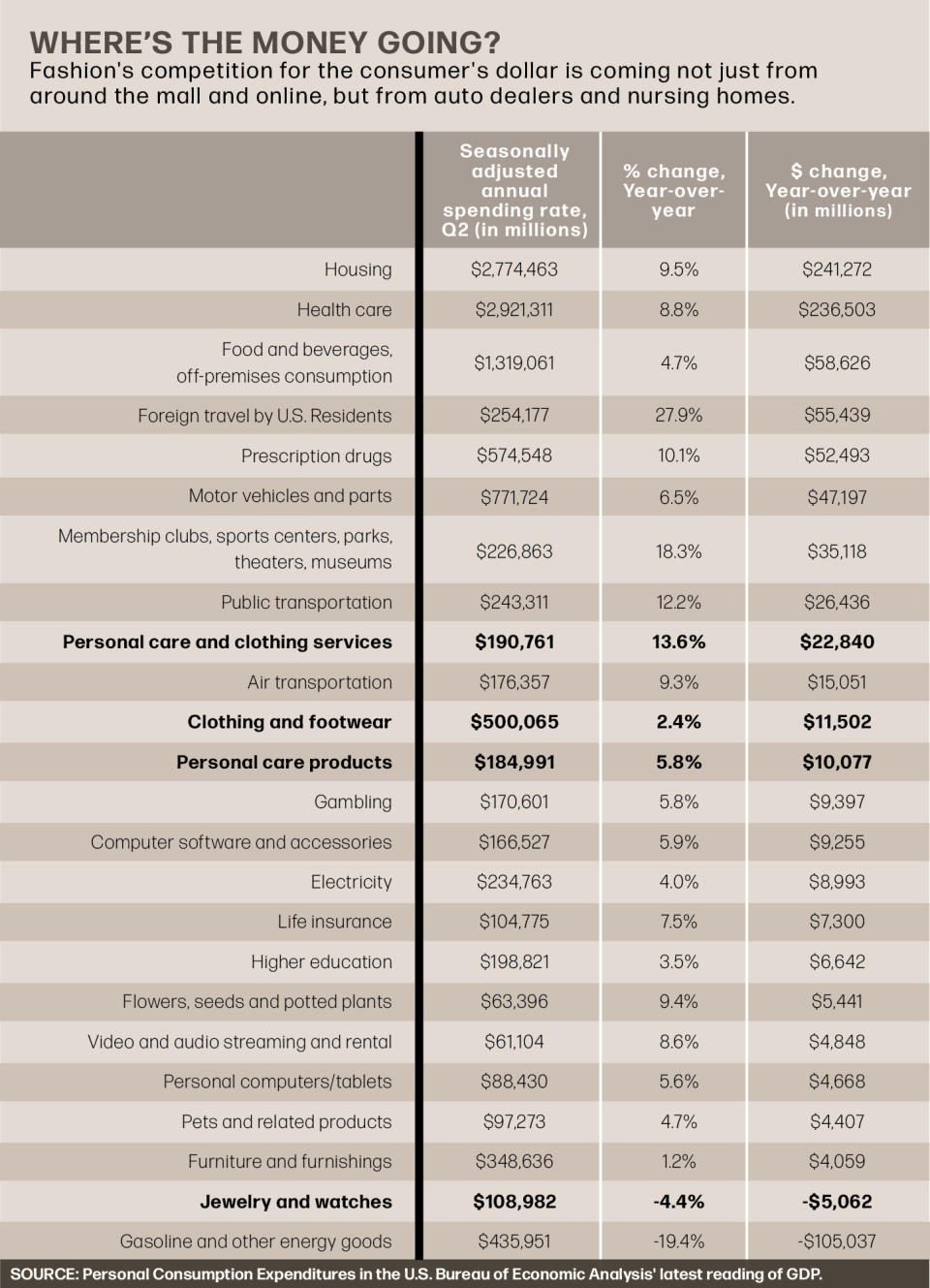

Personal consumption expenditures — a broad measure of spending that looks at goods and services — rose by 6 percent at a seasonally adjusted annual spending rate in the second quarter.

That has consumers dishing more than $1 trillion more at an annual rate than they did a year earlier, according to the U.S. Bureau of Economic Analysis.

But out of that $1 trillion, women’s and girls’ apparel saw a gain of only 2.4 percent year-over-year, or $5.3 billion. By contrast, consumers spent an additional 9.4 percent, or $5.4 billion on flowers, seeds and potted plants; put another 5.8 percent, or $9.4 billion into their gambling habits, and laid out 9.3 percent more, or $15.1 billion, for air travel.

Dwarfing all of that was the additional 9.5 percent more, or $241.3 billion, spent on housing and the 8.8 percent, or $236.5 billion, increase in year-over-year spending on health care.

Competition in the clubby world of fashion can mean Saks Fifth Avenue vs. Neiman Marcus or Tommy Hilfiger vs. Ralph Lauren or Nike vs. Everyone, but the battle for the consumer’s wallet is much broader than that.

One key theme many experts zero in on is the overall spending on goods versus services.

In the five years leading up to the pandemic, consumers spent about 31.5 percent of their dollars on goods. COVID-19 changes in consumer habits pushed that to 34.6 percent in 2021, but the figure and has since retreated to 33.3 percent in the most recent numbers.

If spending on goods continues to revert to the pre-pandemic average, there may be more weakness ahead for fashion.

But for individual brands slugging it out for market share, the macro trends don’t have to be destiny — HotPants can win out over potted plants.

“A lot of times when companies don’t hit expectations, they blame the consumer,” said consultant Greg Portell, lead partner for global client growth at Kearney. “But we know that consumers are out there spending. The companies that aren’t doing well just aren’t giving consumers a reason to spend with them.

“Many retailers got over indexed in the back office versus the front of house,” Portell said. “Adding an IT system or an accountant or a pure engineer that doesn’t enhance the consumer experience is problematic. If I’m a retailer, I’m looking for ways to invest in why a consumer would choose my product. That’s better design, that’s better fabrics, that’s better price points.”

It can also mean giving a little something less tangible to consumers when they buy.

“It’s a bit of a misnomer to draw a distinction between the goods and experiences because in many cases the experience defines the good as well,” Portell said. “If you go to a farmer’s market, you talk to a few people, you meet the neighbors, you learn a story about your product, you may end up with the same bundle of fresh fruit [you would have gotten from the grocery store]. One of the mistakes people make when they think about experience is thinking it needs to be roller coasters and clowns and balloons.”

Fashion and retail have something else to offer, (besides, there are people who do roller coasters better) and they are pressing their advantage as they look to soak up consumer dollars.

The Walt Disney Co. recently said it would double capital expenditures on its Disney Parks, Experiences and Products division over the next decade, spending about $60 billion overall to jazz up its domestic and international amusement parks and cruise line capacity.

Doug McMillon, president and chief executive officer of retail giant Walmart Inc., suggested at the Goldman Sachs Global Retailing Conference that consumers simply want both good and services.

“They want all of it, don’t they?” McMillon said. “I mean everybody wanted to take a vacation and get out and travel and they have, and they are. That probably continues. And on the goods side, as pricing moves around, I think there’ll be enough dollars to be able to get the mix that we want to get.”

These types of consumer trade-offs could only become more important as higher-interest rates work their way through the system and the economy slows.

Jim Doucette, global EY-Parthenon consumer products and retail leader, said spending has kept up with wage growth and that employment is still strong — but that consumers are also starting to spend money they don’t have.

“We know during the pandemic there was this big bump in excess household savings, consumer households, and we’ve done a nice job of running through that and then some,” Doucette said. “So we’ve kind of exhausted that, but are still spending, and now we’re starting to see things like credit card delinquencies.”

The latest reading of EY’s Future Consumer Index, surveying 21,000 consumers in 27 countries, found that 94 percent of respondents were worried about rising household costs.

“While some categories are up, the consumer is feeling pressure and they are looking to save costs, cut back on spending,” Doucette said. “It’s across the board and we look at low, medium and high income households. That’s the mindset that companies should be aware of, that the consumer is looking to reduce cost, reduce spend [and is] worried about overall living expenses.”

To win, brands need to be better than not just the store across the mall or the e-commerce site in the next tab, but better than a roller coaster, too.

Best of WWD