How the Streamers Stack Up Right Now in Subscribers and Revenue | Charts

The major streamers have answered Wall Street loud and clear this earnings season: Look at us! We’re reining in unnecessary spending! We’re restructuring our businesses! We’re licensing out content!

That’s all in response to investors’ new focus on profitability over raw customer numbers, a trend that’s brought the go-go growth of the peak streaming era to an end, with far more scrutiny over metrics like average revenue per user, marketing spend efficiency and the productivity of sprawling content libraries.

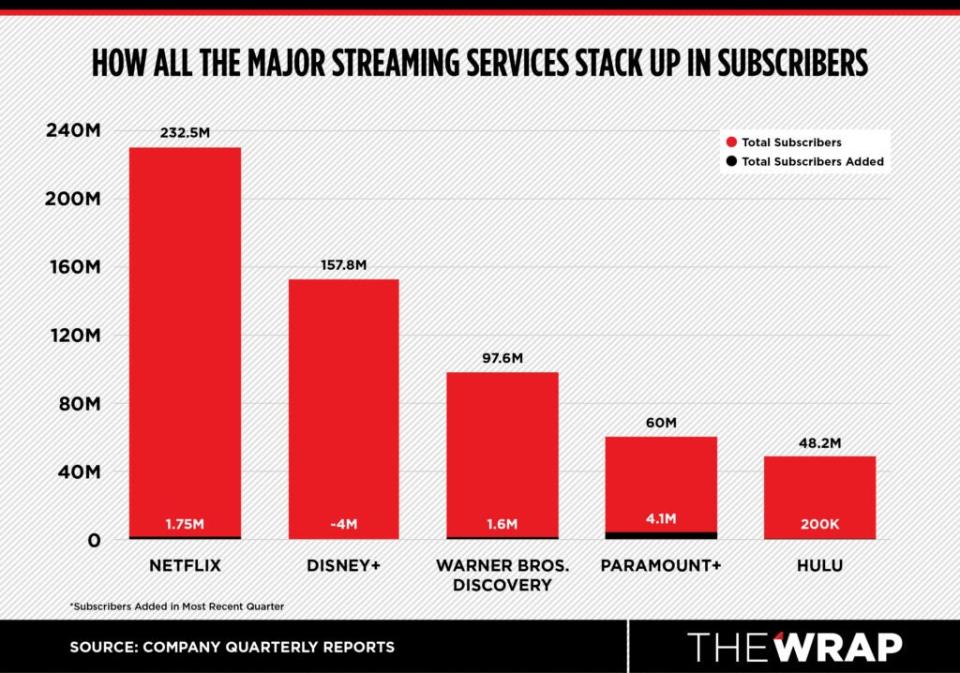

Even as the primary metric of streaming success has shifted away from subscriber growth, each of the major streamers reported a quarterly increase, with the exception of Disney+. Thanks to a price increase, domestic average revenue per user soared at Disney+, but it still came in behind Warner Bros. Discovery, Hulu and Netflix.

It’s worth noting that Netflix is the only streamer thus far that has successfully reached profitability. Paramount and Peacock do not release specific ARPU figures. (Former NBCUniversal CEO Jeff Shell previously told CNBC on Oct. 4 that Peacock is “doing an ARPU of close to $10” on its paid subscribers, though that figure appeared to include advertising revenue, which most other streamers don’t include in their ARPU numbers.)

Two of the biggest streamers, Amazon’s Prime Video and Apple TV+, don’t release quarterly subscriber or ARPU figures. Amazon reported more than 200 million Prime members worldwide in 2021, adding that over 175 million of them had streamed its film or TV content at that time. Both services are divisions of tech giants which see video streaming as an ancillary operation.

So how do the major streamers stack up? Here’s TheWrap’s company-by-company analysis.

Also Read:

‘Citadel’ Soars to No. 1 Among Hottest New Shows | Chart

Netflix

Netflix added 1.75 million subscribers during the first quarter for a total of 232.5 million globally, but noted that it lost 400,000 users in Latin America due to “pull-forward from [the fourth quarter] and ongoing macroeconomic softness.”

The company’s average revenue per user came in at $16.18 in the United States and Canada; $10.89 in the Europe, Middle East and Africa region; $8.60 in Latin America; and $8.03 in the Asia-Pacific region. Revenue in the U.S. and Canada grew 8% year over year to $3.6 billion, while revenue in Latin America grew 3% year over year to $1.07 billion, EMEA revenue fell 6% year over year to $2.5 billion and APAC revenue fell 13% year over year to $934 million. Netflix reported operating income of $1.7 billion and free cash flow of $2.1 billion.

Netflix launched a $6.99 per month Basic With Ads tier in November as it looked to reaccelerate revenue growth. The company said in its shareholder letter that engagement on the ads tier has been above initial expectations and that it’s seen “very little switching” from its standard and premium plans. It also emphasized that the ad tier’s average revenue per paid membership in the U.S. is greater than its standard plan. In January, CFO Spencer Neumann said the company expected that advertising could one day account for 10% of Netflix’s revenue, or around $3 billion. The company didn’t break out a figure for advertising revenue or subscribers to the ad-based tier.

“Given current healthy performance and trajectory of our per-member advertising economics,

particularly in the U.S., we’re upgrading our ads experience with more streams and improved

video quality to attract a broader range of consumers,” the company wrote in its shareholder letter. “We believe these enhancements will make our offering even more attractive to a broader set of consumers and further strengthen engagement for existing and new subscribers to the ads plan.”

Looking ahead, Netflix is forecasting revenue of $8.2 billion in the second quarter, a 3% year over year increase, and operating income of $1.6 billion, roughly flat year over year. It also anticipates revenue growth to accelerate over the course of the second half of 2023 as it continues to improve the service, more broadly roll out paid sharing and grow its advertising business. Netflix will roll out new password-sharing controls in the U.S. beginning in the third quarter of 2023 and improvements to the ad-supported product’s streaming quality.

Also Read:

‘Ted Lasso’ Tops Most-Streamed List – a First for Apple TV+ in 2023 | Charts

Disney+

Disney+ lagged behind its rivals during its second fiscal quarter, with the streamer shedding 4 million subscribers for a total of 157.8 million globally by the end of the quarter on April 1. The service reported 46.3 million subscribers in the United States and Canada, 58.6 million international subscribers (excluding Disney+ Hotstar) and 52.9 million Hotstar subscribers. However, the company continued to see losses shrink in its direct-to-consumer division, which posted an operating loss of $659 million compared to $887 million a year ago.

Overall DTC revenues rose 12% to $5.5 billion. Disney+ saw its average monthly revenue per user in the U.S. and Canada surge 20% during the second fiscal quarter of 2023, increasing from $5.95 to $7.14 due to price increases, though the service still falls below Netflix, Warner Bros. Discovery and Hulu on that front. Disney CEO Bob Iger told analysts on the company’s quarterly earnings call Wednesday that the loss of subscribers from a recent price increase was “de minimis.”

International Disney+ ARPU, excluding Hotstar, grew 6% from $5.62 to $5.93 due to a “favorable foreign exchange impact, a lower mix of wholesale subscribers and an increase in wholesale pricing.” Hotstar ARPU fell 20% from 74 cents to 59 cents. Globally, Disney+ ARPU rose 13% from $3.93 per subscriber to $4.44.

Moving forward, Disney plans to remove “certain content” from its streaming services as a cost-cutting effort and produce “lower volumes of content” to align with the company’s recent strategic shift, executives said. Disney expects to take an impairment charge ranging from $1.5 billion to $1.8 billion, which will appear in the company’s fiscal third-quarter results.

Also Read:

Paramount+’s ‘Scream VI’ Slashes the Streaming Movie Competition for the No. 1 Ranking | Chart

Hulu

Hulu added 200,000 subscribers for a total of 48.2 million, including 43.7 million SVOD-only subscribers and 4.4 million Live TV and SVOD subscribers. Hulu’s SVOD-only ARPU fell 6% from $12.46 to $11.73 due to lower per-subscriber advertising revenue and a higher mix of subscribers to multi-product offerings, partially offset by an increase in average pricing. Hulu’s Live TV and SVOD ARPU climbed 5% from $87.90 to $92.32.

After revealing that Disney+ and Hulu would be combined into one app by the end of the year, Disney CEO Bob Iger has suggested that the future of the hybrid subscription/ad-supported streamer remains in the hands of rival Comcast, which owns a minority stake.

Under a 2019 agreement, Disney can buy out the NBCUniversal parent’s 33% minority stake in Hulu as early as January 2024, or Comcast can require that Disney do so. The terms of the deal require Disney to pay a minimum of $9 billion in either scenario.

In February, Iger said that Disney was looking at Hulu “very, very carefully” and suggested that all options were on the table, including a potential sale. But on Wednesday, he acknowledged on the company’s earnings call that it has “not really been fully determined what will happen in that regard.”

After studying the issue in recent months, Iger said, “it’s clear that a combination of the content that is on Disney+ with general entertainment is a very strong combination from a subscriber perspective… and also from an advertiser’s perspective,” he explained.

According to Iger, Disney has already had “some conversations” with Comcast about the stake.

“They’ve been cordial and they’re aimed at being constructive, but I can’t really say where they’ll end up only to say that there seems to be real value in having general entertainment combined with Disney+ and ultimately Hulu is that solution that we’re bullish about,” he added.

Comcast CEO Brian Roberts previously expressed interest in acquiring Disney’s two-thirds stake in Hulu should it go up for sale, while former NBCUniversal CEO Jeff Shell previously predicted that Disney would write a “big check” for Comcast’s minority Hulu stake. When asked about the Hulu stake during Morgan Stanley’s Technology, Media & Telecomm Conference in March, Comcast president Mike Cavanagh noted that a “very clear and good agreement for a put call” was put in place in 2019 and that any other deal with Disney would have to be “better in our minds than that.”

Representatives for Comcast didn’t immediately respond to TheWrap’s request for comment.

Also Read:

NBCUniversal and Amazon Partner to Add Local News Stations to FAST Services

HBO Max and Discovery+

Warner Bros. Discovery, which runs HBO Max and Discovery+, added 1.6 million streaming subscribers during the quarter for a total of 97.6 million globally.

The direct-to-consumer division reported a profit of $50 million, a $704 million year-over-year improvement on a pro forma combined basis. Revenue for the segment came in at $2.455 billion, including $2.165 billion in distribution revenue, $103 million in advertising revenue and $185 million in content revenue. Average revenue per user came in at $10.82 domestically, $3.48 internationally and $7.48 globally.

CEO David Zaslav revealed that WBD expects its streaming business in the U.S. to reach profitability in 2023, a year ahead of previous guidance. The company, which had said its DTC business would generate a $1 billion profit in 2025, also reaffirmed that aspect of its outlook.

“The key here is our streaming business is no longer a bleeder,” Zaslav told analysts and investors during the company’s earnings call. “It’s hard to run a business when you have a big bleeder.”

The upcoming Max rebrand on May 23, which will see the libraries of HBO Max and Discovery+ combined in a single service, will offer three pricing options: a $9.99 per month Max Ad Lite tier, a $15.99 per month Max Ad Free tier and a $19.99 Ultimate Ad Free tier. The company will also continue to offer a standalone version of the lower-cost Discovery+ service, though Chief Financial Officer Gunnar Wiedenfels said a “large portion” of Discovery+ and HBO Max’s 4 million overlapping subscribers are expected to drop the service a few months after the Max launch.

The latest quarterly results come as Warner Bros. Discovery has been undergoing a major restructuring, which it expects to complete by the end of 2024. The company previously estimated that it will incur up to $5.3 billion in total restructuring charges before taxes, including up to $3.5 billion in content impairment and development write-offs. During the first quarter of 2023, Warner Bros. Discovery recorded $1.81 billion of pre-tax amortization from acquisition-related intangible assets and $95 million of pre-tax restructuring expenses.

Paramount+

Paramount+ added 4.1 million subscribers during the first three months of 2023 for a total of 60 million globally. Losses in the streaming business increased to $511 million in the quarter compared to $456 million a year ago, but fell from $575 million in the December quarter.

Revenue in Paramount Global’s direct-to-consumer division grew 39% year over year to $1.5 billion. Paramount+ revenue grew 65% year-over-year driven by subscriber growth and increased advertising revenue. Subscription revenue grew 50% year-over-year to $1.1 billion, principally reflecting subscriber growth on Paramount+, including the benefit from previous launches in international markets. Advertising revenue rose 15% year-over-year to $398 million, driven by strong engagement on Paramount+.

A previously announced integration of Showtime into Paramount+ will officially launch in the third quarter, the company confirmed. The combination, which is expected to generate approximately $700 million in future annual expense savings, resulted in a programming charge of $1.7 billion during the first quarter. As part of the move, the company is raising its prices for Paramount+ subscriptions. The top tier of Paramount+ will rise to $11.99 per month from $9.99 per month. The cheaper, ad-supported Essentials tier, which won’t include Showtime, will increase to $5.99 from $4.99 per month. Consumers who already pay for the Paramount+/Showtime bundle won’t be affected by this price increase.

Looking ahead, executives said the company remains on track for peak streaming investment in 2023 and a return to free cash flow in 2024. Management expects subscriber additions in the second quarter to be “seasonally a little softer” but noted that growth would pick up again in the back half of the year. Paramount also slashed its quarterly dividend to 5 cents a share, down from 24 cents a share.

Also Read:

Hollywood, Are You Team Human or Team AI? It’s Time to Choose | PRO Insight

Peacock

NBCUniversal’s Peacock added 2 million net paid subscribers during the quarter for a total of 22 million subscribers, up 60% year over year but representing slower growth than in the fourth quarter, when it added 5 million subscribers.

The streamer saw revenue climb 45% year over year to $685 million but posted an adjusted EBITDA loss of $704 million, compared to $472 million of revenue and an adjusted EBITDA loss of $456 million in the prior year period. Executives reaffirmed previous guidance that Peacock’s losses will peak at around $3 billion in 2023.

“We believe we have the right strategy for Peacock and one that’s suited to our strengths. Premium content with a dual revenue stream, both advertising and subscription fees, and we’re encouraged by our results so far, growing paid subscribers and engagement levels to roughly 20 hours per subscriber per month, fueling strong growth in advertising revenues,” Comcast president Mike Cavanagh said. “We’re investing, but the results we are seeing give us confidence that we are on the right path for Peacock to break even and grow from there.”

Also Read:

AI and the Law: It’s the ‘Wild, Wild West’ Out There