A Prime Video Ad Tier Could Be a Cash Cow for Amazon – but It’s Not Without Risks | Analysis

“Unlimited, commercial-free, instant streaming” of thousands of movies and TV shows for anyone signed up for Amazon’s $79-a-year free shipping program. That was a key promise when the online retail giant introduced Prime Video in 2011.

A lot has changed in a dozen years. The price of Prime has nearly doubled to $139 a year, and consumers are flocking to cheaper, ad-supported video subscriptions. And Amazon has become a big player in online advertising. Now the company is reportedly mulling a cheaper version of Prime Video with ads — and it could pay off for Amazon in multiple ways, experts told TheWrap. In fact, it may have no choice, as its competitors see ads subsidize spending on content.

“This would be a smart and potentially must-do move for Amazon,” Kevin Krim, president and CEO of advertising analytics firm EDO, told TheWrap.

Yet the move requires some tricky decisions for Amazon, which has long marketed Prime Video as a feature of its Prime membership, which includes a range of services and benefits from streaming music to discounts on groceries at Whole Foods.

Also Read:

Amazon Plans to Launch Ad-Supported Prime Video Tier (Report)

A big opportunity

An ad-supported Prime Video tier has the potential to generate $4.8 billion a year in the United States, with a 50% profit margin, by 2025, Morgan Stanley analysts estimated in a recent research report. They predict that there will be 73 million Prime Video viewers in the U.S. in 2025.

In 2021, Amazon said that over 175 million of its more than 200 million Prime members at the time had streamed its video content in the past year, but the company hasn’t updated those numbers or provided breakdowns between full or video-only subscriptions. Besides the annual plan, customers can pay $14.99 a month for full Prime membership or $8.99 per month just for the video service.

The bank analysts made one key assumption for their “base case”: that Amazon would only serve ads to customers who get Prime Video included with Prime, not those who pay for standalone video subscriptions. They estimated that Prime Video subscribers would spend 30 minutes to an hour on the service daily — below Netflix usage, and taking into account some “erosion” from customers turned off by the ads.

A U.S. Prime Video ad offering could achieve a $30 CPM, or cost per thousand impressions, according to the analysts — a price between broadcast and cable TV advertising rates. That translates to monthly average revenue per user of $7 on the high end, the analysts wrote.

Also Read:

Streaming May Not Be Commercial-Free Much Longer | Analysis

The estimates hinge on three unknown factors: consumer adoption of a higher-priced, ad-free tier; further content investment which could bring down the profit margin; and whether the tech giant’s AI tools and rich consumer data could boost ad performance. Internationally, ads are a trickier proposition, the analysts wrote, and not likely to bring in nearly as much as in the U.S.

An Amazon spokesperson declined to comment on the possibility of an ad-supported Prime Video tier.

Feeding the content beast

Unlocking advertising as a revenue stream could make Prime Video more, not less, attractive to subscribers if Amazon invests some of that money in providing a broader range of content. Producing large libraries of high-quality programming is expensive, Michael Bologna, an executive at ad-tech firm Brightline, pointed out: “Subscription dollars alone won’t cover the scope of what TV audiences are accustomed to.”

Amazon invested approximately $7 billion in 2022 across Amazon Originals, live sports and licensed third-party video content included with Prime, up from about $5 billion in 2021, Chief Financial Officer Brian Olsavsky told investors during the company’s fourth-quarter earnings call. Total video and music expenses were $16.6 billion in 2022, up from $13 billion in 2021.

Also Read:

Can Super Bundles Save Streaming? | Analysis

In the first quarter of 2023, Amazon reported $9.5 billion in ad revenue, a 21% year over year increase. That works out to a nearly $40 billion-a-year business — even before Amazon taps the potential of ads on Prime Video.

“Amazon is the poster child for mastering ads, search, goods, services, memberships and subscriptions,” Constellation Research founder Ray Wang said. “The ad-supported tier will help Amazon go from $40 billion in ads to $100 billion by 2030.”

Lots of competition

Netflix, which established the ad-free model Amazon openly imitated, has introduced a cheaper streaming plan with ads, as have Disney, Paramount and Warner Bros. Discovery. Hulu has long offered a cheaper ad-supported version, as has NBCUniversal’s Peacock. There’s also competition from free, ad-supported services like Pluto, Tubi and the Roku Channel. Amazon has its own FAST service called Freevee.

Also Read:

Amazon Freevee to Launch 12 MGM, 11 Warner Bros. Discovery FAST Channels

Disney and Netflix haven’t broken out subscriber figures for their respective ad tiers. However, Netflix revealed in May that the offering has grown to nearly 5 million monthly active users globally since launch. The ad tier’s average revenue per paid user in the U.S. is greater than Netflix’s standard ad-free plan, the company noted in its first-quarter earnings report.

About 40% of new Disney+ subscribers choose the ad tier, Disney advertising executive Josh Mattison recently told Variety, and impressions available to advertisers have grown tenfold, he said, suggesting a rapid growth in audience.

Amazon already has a considerable audience for video advertising, offering advertisers access to an average monthly audience of more than 155 million viewers in the U.S. alone through the NFL’s “Thursday Night Football,” Freevee, game-streaming service Twitch, channels on its Fire TV devices and third-party publishers.

Freevee has already validated that the ad-supported streaming model for Amazon, Interactive Advertising Bureau CEO David Cohen told TheWrap, and an ad-supported Prime Video tier would provide advertisers and creators “even more opportunity to reach their desired audiences,” he said.

Also Read:

Inside the Turmoil at TCM After Executive Exodus: ‘They’re Farming Most People Out’ | Exclusive

According to EDO, ads that streamed during Amazon’s inaugural “Thursday Night Football” season were 16% more effective than the prime time average. Krim noted that an advertiser would need to air about 39 spots across prime time TV to generate as much engagement as a single ad during the Amazon-streamed “Thursday Night Football” last season.

Ad-supported video on demand will be “the main driver of growth” in internet TV from 2022 to 2027, Pricewaterhouse Coopers predicted in its latest annual entertainment and media outlook. AVOD will outgrow subscription video on demand over that time period at 14.2% a year versus 6.1% a year, the consulting firm wrote. That translates to $9.2 billion in growth in the SVOD market versus $16.3 billion in growth in the AVOD market, according to PWC’s forecast.

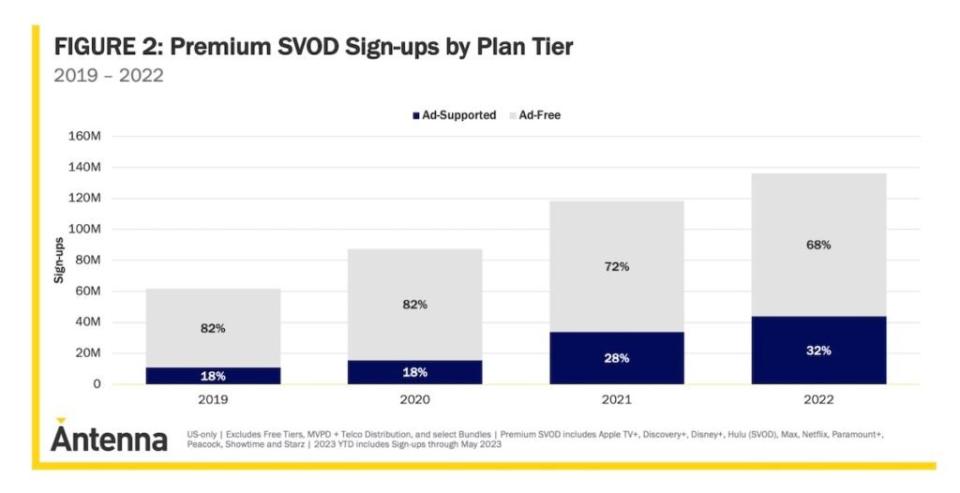

The shift is already underway. Researchers at Antenna found that ad-based streaming plans accounted for nearly a third of new subscriptions in 2023, up from 28% in 2022 and 18% in 2021.

The question for Amazon becomes what to do with its existing Prime subscribers as it woos those millions expected to drop cable or satellite subscriptions over the next few years. One option under consideration is rolling out more ads to them and charging more for an ad-free alternative with additional features, according to the WSJ. Morgan Stanley’s analysts made similar assumptions in calculating their estimates.

While Gerber Kawasaki managing partner Hatem Dhiab believes a Prime Video ad tier is a “winning formula” to court new subscribers, he argues pushing more ads upon existing Prime members and charging more for an ad-free option would be a “tough sell.”

“I’m not sure people will be willing to pay since the content is frankly not that compelling, especially with all the competition from other streamers,” he told TheWrap.

Fitz-Gerald Group founder Keith Fitz-Gerald pointed out that many subscribers dropped cable for streaming to avoid advertisements. If Amazon were to charge more for an ad-free alternative, other streamers will follow suit, giving consumers “the short end of the proverbial stick,” he added.

“The oldest law in the book is that you never go out on price because there’s no recovery,” he added. “The first streamer to increase benefits will win.”

Also Read:

2 Years in, Amazon CEO Andy Jassy Faces Challenges at Every Turn | PRO Insight