Netflix Originals Are Falling Behind the Competition in Audience Demand | Charts

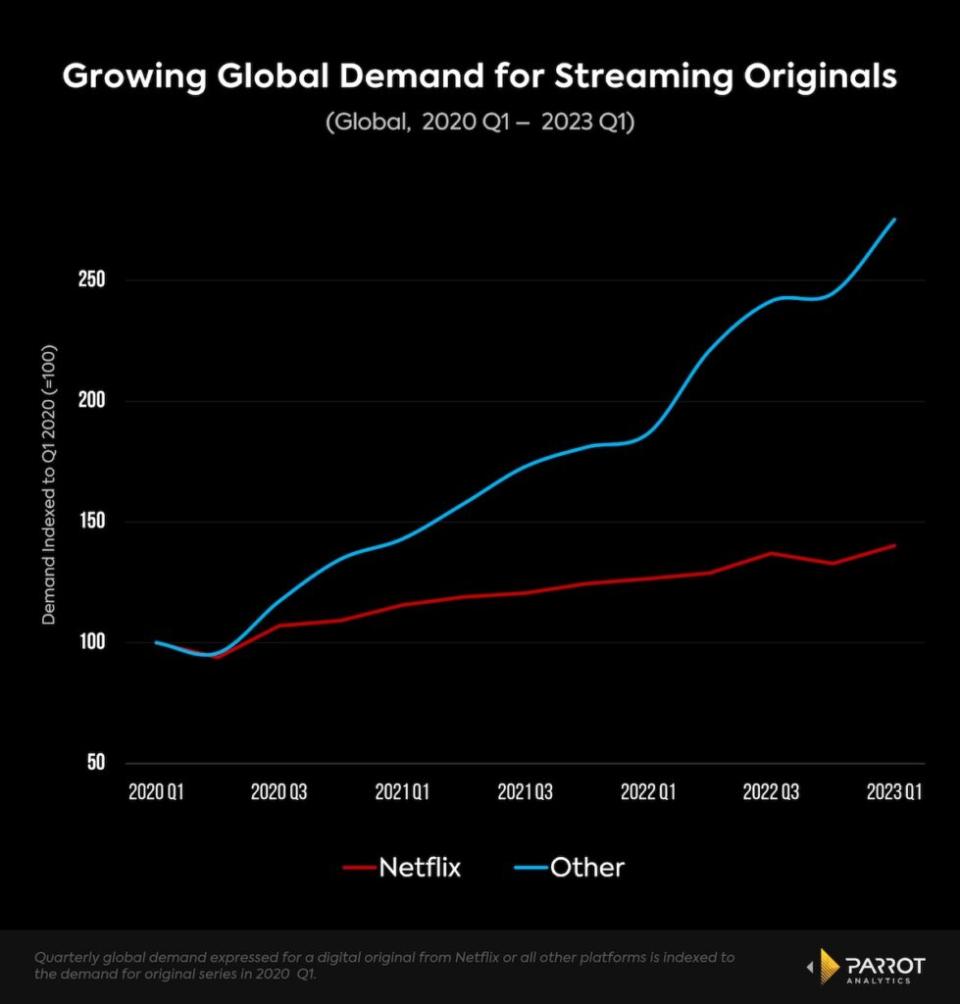

Netflix needs to step up its investment in original content. This is a tall order however as data shows how the pace of growth in demand for Netflix’s originals has lagged its rivals, according to Parrot Analytics data, which takes into account consumer research, streaming, downloads and social media, among other engagement.

Competitors are growing their originals slate at a faster rate, which means that Netflix’s global share of demand for streaming originals hit another record low of 37.9% in the first quarter. This is down from 55.7% in the first three months of 2020, when HBO Max, Peacock and Paramount+ had yet to make an appearance.

Historically, Netflix has held onto a lead over Hulu and HBO Max in audience demand for its content. Going forward, it will have to play catch-up to Max, a stark turnaround showing the growing competitive stakes in streaming.

Also Read:

Netflix Remains Dependent on Licensed Shows Like ‘Breaking Bad’ | Charts

We’ve shown how Netflix’s dependence on licensed content is a competitive risk for the streamer in today’s heated battle for audience attention. In the U.S., seven of the 10 most in-demand shows available on Netflix in the first quarter of 2023 were licensed.

Warner Bros. Discovery’s recently announced Max service, formed by merging the HBO Max and Discovery+ catalogs, would’ve had more demand for all of its content than Netflix in the same period.

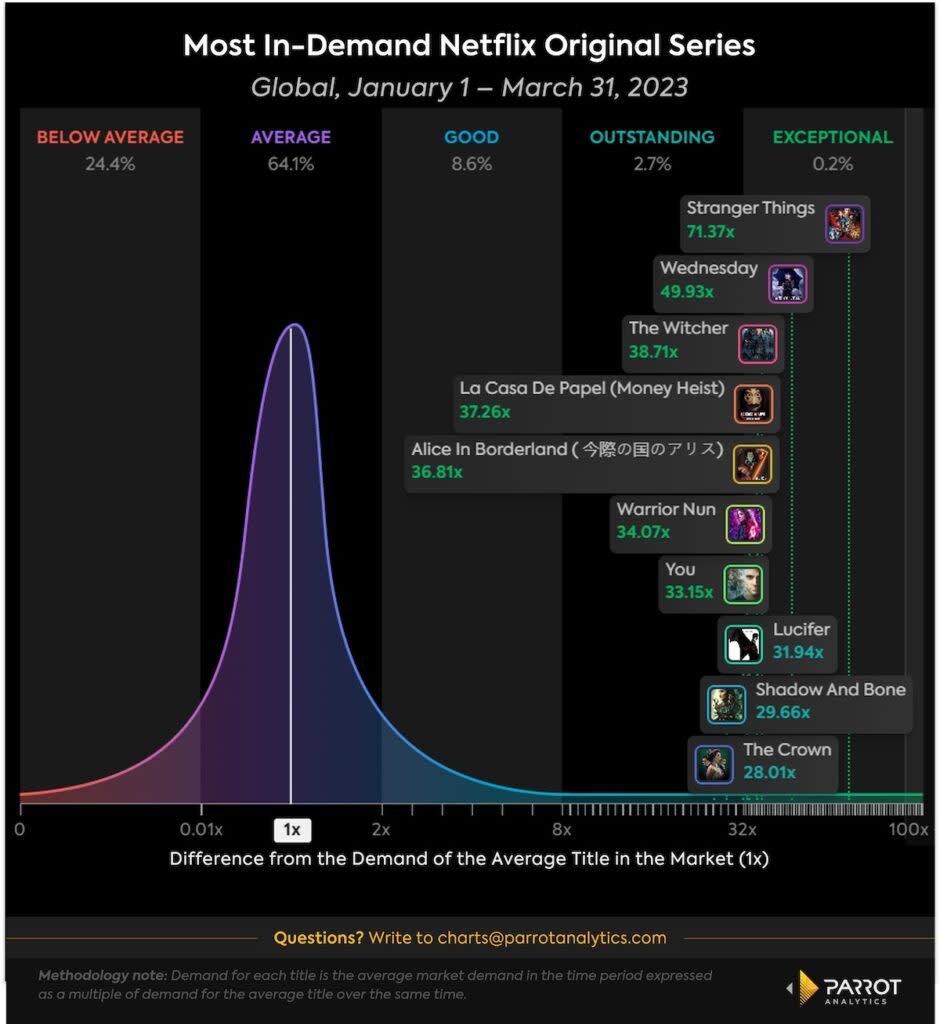

Having highly in-demand original content will be particularly important as the company cracks down on password sharing and seeks to justify its value to potential new subscribers who were previously getting it for free. A look at the most in-demand Netflix originals in the first quarter points to the opportunities and risks in Netflix’s slate of originals.

Global demand for “Wednesday” has held up well since it premiered in November. It still had nearly 50 times the average series demand in the first quarter, which points to the potential for future seasons of this show to be a flagship Netflix offering.

Demand for “The Witcher” got a boost from the release of a prequel miniseries, “Witcher: Blood Origin,” at the end of December. With a new season scheduled for this year, “The Witcher” will continue to draw audiences to Netflix. This example also points to Netflix investing in franchise extensions that raise demand for the entire franchise.

Netflix is capitalizing on growing global demand for anime content with its investments in original anime like “Alice in Borderland.” The show had 36.8 times the average series demand for the quarter.

The number of concluded or canceled series among the top 10 Netflix originals presents a potential risk for the streamer. “Money Heist” and “Lucifer” both ended in 2021. “Warrior Nun” was canceled at the end of last year, sparking fan outrage. The final season of “The Crown” is expected this year. The streamer’s slate of originals is ready for a refresh: Will Netflix find its next “Wednesday” soon enough?

Christofer Hamilton is a senior insights analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

How HBO Max Can Poach Customers From Disney+ and Paramount+ (and Vice Versa) | Charts