Comcast Contends With Peacock Losses, Labor Unrest and Cord Cutting | Analysis

Comcast investors will get a closer look Thursday at Mike Cavanagh and Brian Roberts’ strategy for getting Peacock to profitability and revamping NBCUniversal’s leadership as the cable company reports its second-quarter earnings.

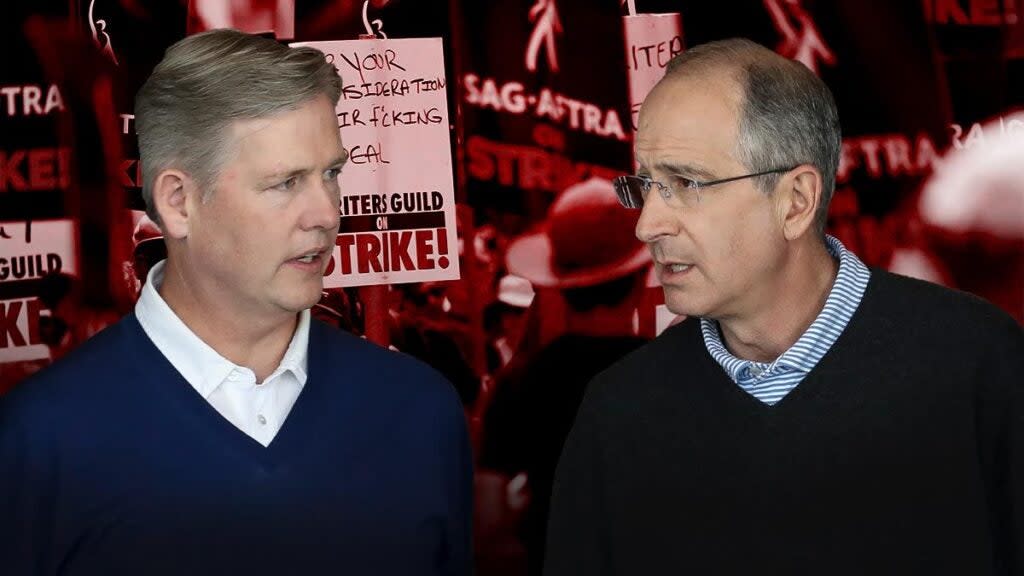

Over the last several months, that strategy has been complicated not only by the existential threat of cord-cutting in the traditional TV business but also the historic double strike by SAG-AFTRA and the Writers Guild of America.

The direct effects of the labor dispute won’t be visible in the quarter’s results, which ended in June before talks between the studios and SAG-AFTRA broke down. But Michael Hodel, Morningstar’s director of equity research for media and telecommunications, anticipates the topic will loom large over the earnings call. It might even help the company’s bottom line, at least in the near term.

“I expect the actors’ and writers’ strikes will be a topic of conversation as it relates to Peacock and NBCUniversal’s ability to grow the service over the balance of the year,” he told TheWrap. “That said, I wouldn’t be surprised if Comcast reduced the loss it expects Peacock to generate in 2023 at least somewhat with spending on new development largely halted.”

Benchmark analyst Matthew Harrigan, who currently has a buy rating on Comcast stock, expects the NBCUniversal parent to be better positioned to weather the double strike than other studios given its “high reality show programming component.” He also said Peacock would benefit from NBC’s sports programming as well as Universal’s movie slate, which flows to the streamer, he wrote in a note to clients this month.

Peacock profits

At the end of the first quarter, Comcast reported that Peacock had a total of 22 million paid subscribers, making it the smallest general-interest streamer operated by a major media company. Peacock’s revenue climbed 45% year over year to $685 million but its adjusted EBITDA loss widened to $704 million. Executives have previously said that they expect Peacock’s losses to peak at around $3 billion in 2023.

To help Peacock reach profitability, NBCUniversal is hiking prices on its Premium and Premium Plus subscription tiers to $5.99 and $11.99 per month respectively. While Hodel expects Wall Street would “likely view such a development favorably,” he warned that the “long-term future of Peacock is still a big uncertainty.”

“We would like to see Comcast rethink Peacock pricing so that it better complements the traditional television business given that traditional television is still at the core of NBCU’s business,” he added. “We would also like Comcast to partner closely with another large media firm on its streaming effort to improve scale.”

Warner Bros. Discovery CEO David Zaslav recently proposed that media companies team up to form “super bundles” of services. Comcast hasn’t introduced such an offering, but it did launch Now TV in May, a $20 per month subscription that includes live TV channels, Peacock, and FAST streaming channels.

Shaking up NBCUniversal

In addition to Peacock, Cavanagh may also face questions about his broader strategy for NBCUniversal, which Comcast CEO Brian Roberts has placed under his direct oversight.

Cavanagh recently elevated Donna Langley to NBCUniversal Studio Group chairman and chief content officer and Mark Lazarus to NBCUniversal Media chairman. The promotions, which are designed to streamline the network’s operations, prompted the departure of top TV executive Susan Rovner and followed the abrupt firing of CEO Jeff Shell in April and the exit of NBCUniversal sales chief Linda Yaccarino in May.

“I am sure the firm will get questions about [NBCUniversal’s] strategy under Mike Cavanagh, especially given that he is a media outsider,” Hodel said. “But I would expect the firm will give the same sort of responses it has over the past couple of years in response to promotions, layoffs and restructurings: that the firm needs to be leaner, more unified across various groups and ultimately more nimble to compete in the current media landscape.”

Broadband strength

As Hollywood watches for updates around Peacock, NBCUniversal and the strike, Wall Street will be paying especially close attention to Comcast’s broadband customer growth, Hodel said.

“The second quarter is typically seasonally weak for broadband customer growth, so there might not be much to read into results,” he said. “That said, I would expect investors to look for any sign that market share gains among fixed-wireless players, primarily T-Mobile and Verizon, are slowing and that broadband pricing remains healthy, with continued low-to-mid single digit growth in average revenue per customer.”

He also anticipates considerable focus on free cash flow and the pace at which Comcast is repurchasing shares.

“We believe share buybacks are one of the best uses of capital for the firm right now,” he added.

Labor on the watch

A big share buyback, however, risks igniting the ire of striking writers and actors, who might call attention to the money Comcast is funneling to investors rather than using to increase their compensation. Already, the unions have taken aim at media executives’ outsized compensation packages.

“My message to [shareholders] would be that our proposals are about basic respect,” SAG-AFTRA national executive director and chief negotiator Duncan Crabtree-Ireland told TheWrap during the union’s “Rock the City for a Fair Wage” rally in Manhattan on Tuesday. “They’re not overreaching.”

He specifically called out Netflix, which just reported $1.5 billion in net income for its second quarter and has seen its stock price climb 45% year to date.

“The fact is these companies have been building new platforms that take some investment — but that investment is paying off. Netflix was the first mover in this area and look how they’re doing now,” Crabtree-Ireland said. “So let’s none of us be fooled by the fact there is still investment going on at some of these other companies with newer [streaming services]. They’re going to become successful and they need to share that success in a reasonable way with our members. So investors ought to tell these companies to be fair to the talent, to the creatives who make your business exist.”

Analysts surveyed by Zacks Investment Research expect Comcast to report earnings of 98 cents per share on revenue of $30.3 billion. Ahead of the quarterly results, Comcast shares are up 22% year to date.

The post Comcast Contends With Peacock Losses, Labor Unrest and Cord Cutting | Analysis appeared first on TheWrap.