How the Streamers Stack Up in the Battle for Anime Fans | Charts

Demand for anime just keeps growing, but tapping into the trend has been challenging even for Netflix. Of mainstream American streamers, only Hulu, which recently introduced a dedicated hub for the Japanese-born animation style, has captured an outsized share of the market.

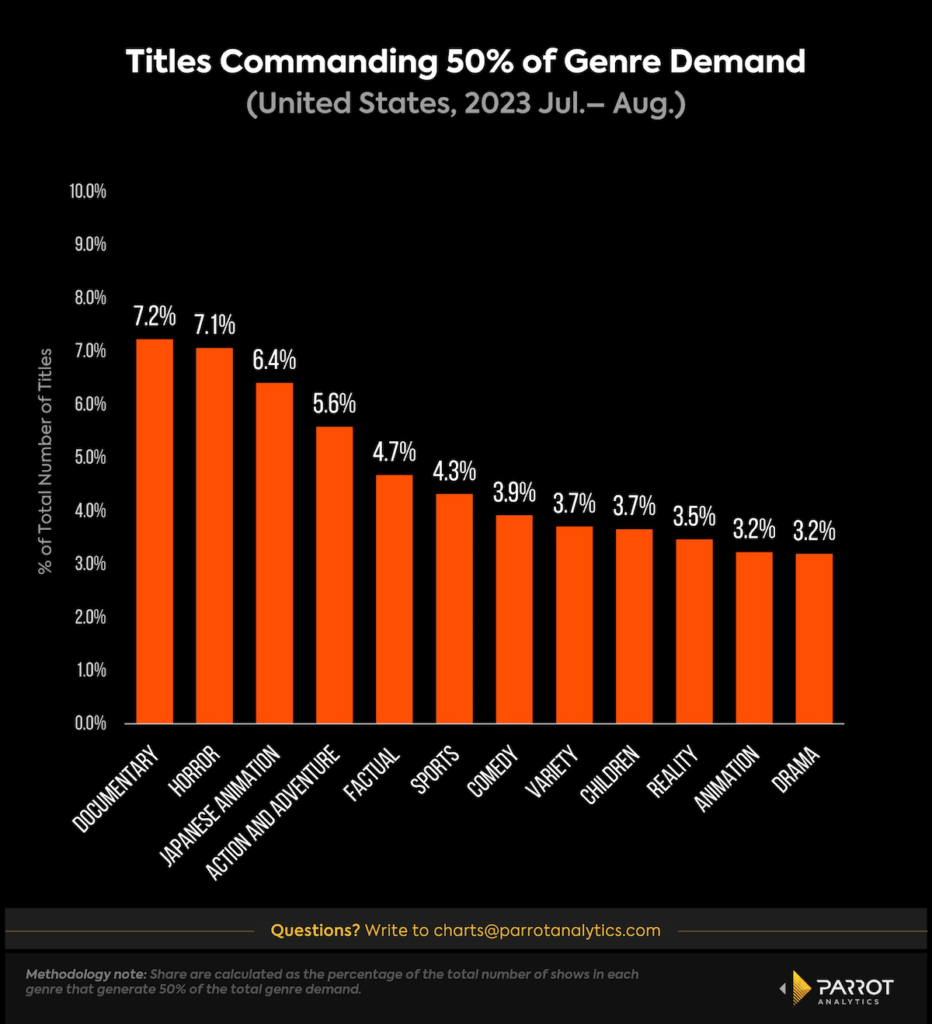

Data from Parrot Analytics reveals that anime accounted for 5.1% of the total demand for shows in the U.S. in July 2023. This significant interest has ignited intense competition among streaming services vying for Japanese titles. Subscription streamers value anime because of its potential for subscriber retention. And unlike more hit-driven genres, demand for anime is more evenly spread across a broad range of shows.

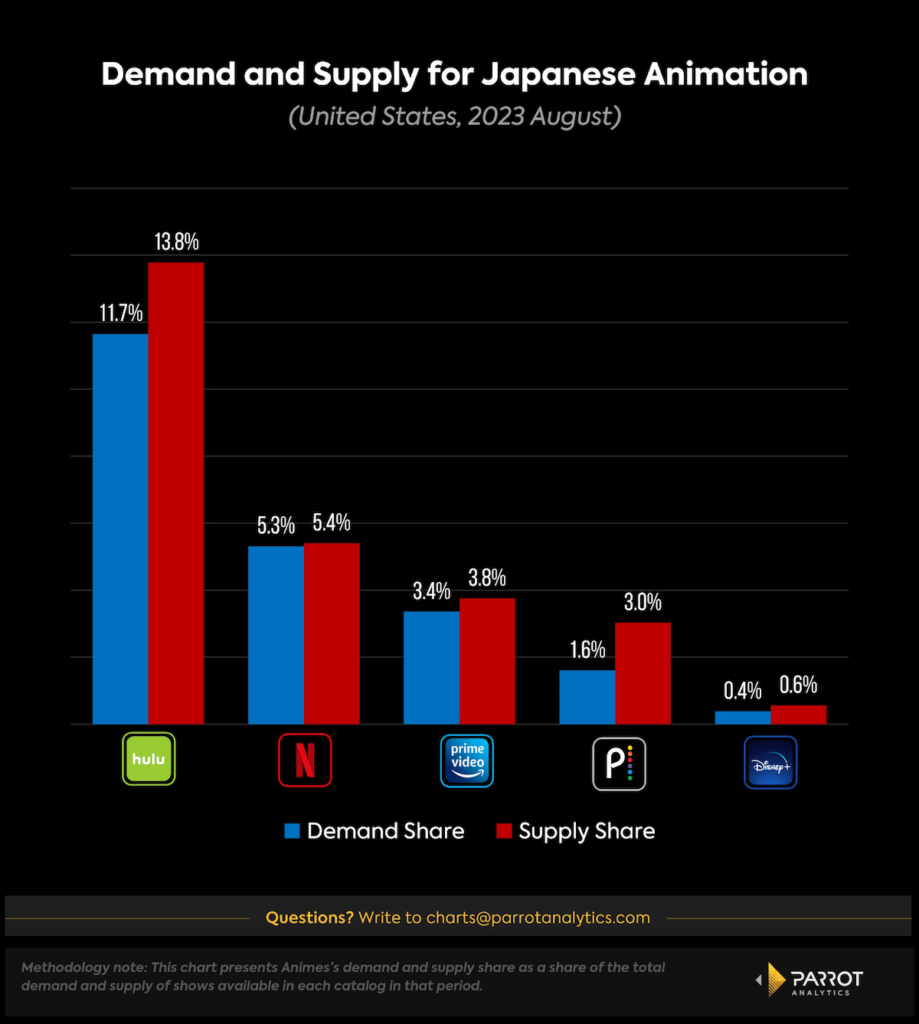

Besides Crunchyroll, the Sony-backed all-anime streamer, Hulu boasts the highest demand for anime content, at 11.7% of its overall TV catalog demand. Remarkably, Hulu’s library features nine of the 10 most in-demand anime in August, including exclusive titles like “My Hero Academia,” “Attack on Titan,” and “Bleach.”

Netflix pioneered the anime trend among SVOD services as the first to heavily invest in the medium and collaborate with Japanese animation studios. As of now, Netflix holds the second-highest demand share for anime at 5.3%. Despite its efforts, it’s just in line with the overall market. Its most popular titles include “One Piece,” the top anime in the U.S. last month, which is gaining traction due to the recently launched live-action series, as well as “Naruto” and “Jojo’s Bizarre Adventure.”

Newer entrants to the anime scene include Amazon’s Prime Video, Peacock and Disney+. They typically invest in renowned but nonexclusive titles like “Naruto” (available on Prime Video, Netflix and Peacock) and “Vinland Saga” (accessible on Prime Video and Netflix). Presently, anime constitutes 3.4% of Prime Video’s demand, 1.6% of Peacock’s and a mere 0.4% for Disney+.

Interestingly, across all major services, the supply of anime surpasses demand, which suggests streamers might be acquiring shows without regard to which ones resonate with viewers. It’s possible that gap could lead to a future culling of libraries. This disparity is most evident on Hulu, which has the most extensive anime catalog and the widest supply-demand gap. Conversely, Netflix’s minimal difference between supply and demand implies its efficiency in selecting anime.

The challenge might be magnified by the fact that demand for anime is more evenly spread across a wide range of titles. There are fan favorites like “Dragon Ball,” “Pokémon” and “Naruto,” which remain popular decades after their debut; licensing those shows to build up an anime library is a no-brainer. But anticipating the next anime hit isn’t as easy.

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

The post How the Streamers Stack Up in the Battle for Anime Fans | Charts appeared first on TheWrap.