Executives Shine Light on Physical Stores

MILAN — It’s not abiding by the 20-year fashion cycle, but another trend is coming back with a bang.

After online sales were deemed the be-all and end-all during the COVID-19 pandemic, a walk around Milan’s luxury shopping district ahead of the city’s fashion week, kicking off Wednesday, illustrates the investments fashion brands are channeling into their retail networks. And after embracing quick thinking and reaction throughout the pandemic, mapping out long-term strategies is no longer taboo despite the ongoing socio- and macroeconomic uncertainties.

More from WWD

Sabato De Sarno on Gucci's New Imagery, Freedom and Show Debut

Miuccia Prada Formally Takes On Fondazione Prada's Director Role

Eddie Bauer Revamps Messaging, Focuses More on Wholesale, International Growth

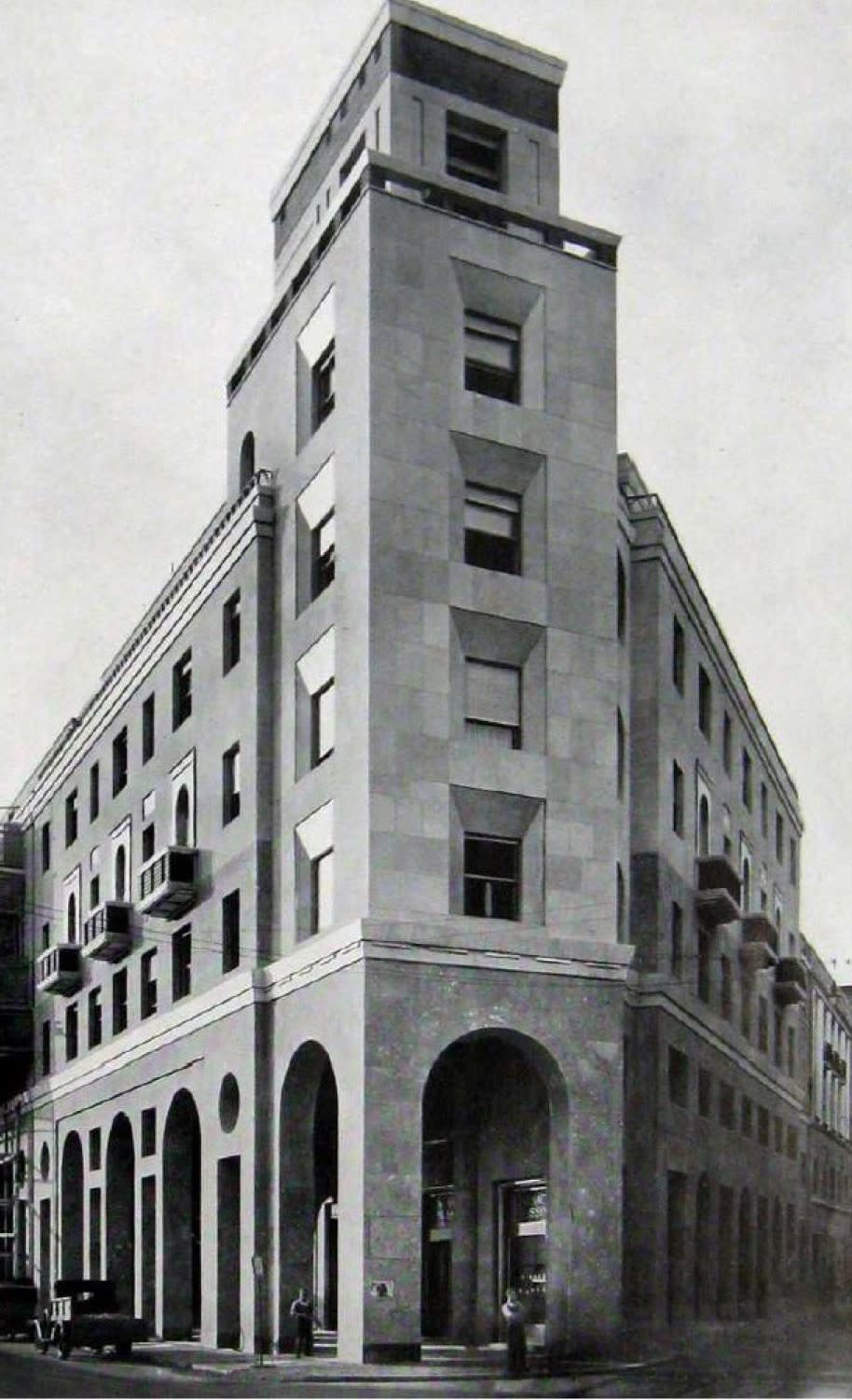

Fendi’s chairman and chief executive officer Serge Brunschwig revealed that a major new “retail experience” will be inaugurated in Milan in 2025 as part of the brand’s 100-year anniversary celebrations.

The flagship will stand in Via Montenapoleone at the corner of Corso Matteotti.

“Milano is one of the most unique destinations when it comes to combining fashion and design, and is strongly connected to Fendi culture,” Brunschwig said. “Following the openings of Palazzo Fendi in Seoul and Tokyo Omotesando earlier this year, Palazzo Fendi Milano will be a milestone in the maison’s history.”

As reported, Fendi in February opened its first freestanding store at street level in Seoul, which spans more than 7,720 square feet, with an impressive facade, more than 52 feet high, characterized by a combination of geometric diagonals in stainless steel finishing and central glass windows that converge toward the corner of the building and LED arches. These are a Fendi signature, recalling those of the company’s headquarters in Rome’s Palazzo della Civiltà Italiana. Likewise, the structure of the flagship in Omotesando, one of the largest Fendi stores in Japan, is equally striking and was inspired by the Karl Lagerfeld Astuccio fur cape.

Fendi’s parent LVMH Moët Hennessy Louis Vuitton is certainly expanding its footprint in Milan. According to Milan-based sources, Tiffany & Co., also controlled by LVMH, is planting its first flag on Via Montenapoleone. The brand operates two units in the city, on neighboring Via della Spiga and on Corso Vittorio Emanuele II.

Sources say Bulgari is expected to move to the space currently occupied by Louis Vuitton in Palazzo Taverna on Via Montenapoleone, while the latter is seen as further expanding in the building. While Vuitton’s flagship is being revamped, the brand has opened the doors to Garage Traversi, a long-running temporary destination in town, taking over three stories of the renovated space and dropping its collection with Japanese artist Yayoi Kusama. The building is a former car park dating back to 1939.

Chanel is also planting its first flag on the street, partially taking over the spaces formerly occupied by menswear brand Larusmiani. The boutique will flank the Gucci flagship that is also undergoing renovation. It is unclear whether this location will replace the existing unit on Via della Spiga. Chanel has also won a bid for the concession on a 2,030-square-foot space inside Galleria Vittorio Emanuele II for an annual fee of 2.35 million euros, replacing Tod’s.

But Milan isn’t the only city attracting the stores of luxury brands.

Bottega Veneta is expanding its 12 Avenue Montaigne boutique in Paris by adding 3,240 square feet of retail space, which is expected to officially open on Sept. 25. “Beyond a boutique, the space unveils a universe expressing the unique craft and extraordinary creativity that sets Bottega Veneta apart,” said the brand’s CEO Leo Rongone. “With its new design, the store has been conceptualized as a salon where true luxury comes to life.” Elevating the customer experience, the brand’s entire collections will be represented as well as new personalization services.

Gucci, meanwhile, continues to roll out its ultra-luxe store concept called Salon, which debuted last April in L.A., and which focuses on its wealthiest shoppers. The L.A. Salon is the first of nine permanent and temporary ones to be opened in New York, Paris, Milan, London, Dubai, Hong Kong, Shanghai, Tokyo and Taipei, Taiwan, each with its own collection of products.

Executives have been highlighting the strong performance of their brick-and-mortar stores as they reported quarterly or first-half results.

For the first time in its history, Moncler Group revenues exceeded the 1 billion euro mark in the first half of the year and chairman and CEO Remo Ruffini underscored that the direct-to-consumer channel reported revenues of 757.5 million euros, up 36 percent. Like-for-like comparisons had basically disappeared during the pandemic but returned in some cases, including Moncler, which registered a 34 percent gain in the first half.

In July, commenting on Prada Group’s strong performance in the first six months of the year, which saw net profit soar 62 percent to 305 million euros and revenues gain 17 percent to 2.23 billion euros, group CEO Andrea Guerra took a long-term perspective that involves continuing to invest in the group’s brands, “maintaining maximum focus on retail execution and productivity. For the current year, we retain our ambition to deliver solid, sustainable and above-market growth,” considering a more challenging comp base in the third quarter and some COVID-19 restrictions during the final quarter of last year.

Thom Browne, controlled by the Ermenegildo Zegna Group, opened 13 direct-to-consumer stores in the last 12 months and the plan is to continue to expand the footprint over the next few years, according to CEO Rodrigo Bazan.

Ubaldo Minelli, CEO of OTB Group, said the year 2023 is “proving to be very positive” for the company and that growth is focused on the direct channel, in particular on retail, “thanks to new openings but especially to an important organic growth of all the retail network.”

OTB comprises Diesel, Jil Sander, Maison Margiela, Marni and Viktor & Rolf, as well as manufacturing companies Staff International and Brave Kid, and holds a minority stake in the Amiri brand.

The group is making a major statement in Venice, where Jil Sander and Marni boutiques opened earlier this year, and Maison Margiela is next soon, followed by Diesel early next year — all in the world famous Piazza San Marco. A Maison Margiela store with a café opened in Beijing’s Taikoo Li Sanlitun area last month, as well as a store in Hangzhou and Changsha. This year, Diesel has opened doors in Paris’ Rue Saint Honoré, Miami and Mykonos while Jil Sander has opened stores in Los Angeles, in Rome near the Spanish Steps and in Hangzhou.

The group has more than 600 stores worldwide. By the end of the year, OTB will have opened 80 new stores, the same number it has earmarked for 2024.

In the first six months, all of the brands and companies of the group registered good growth and “we are confident the positive trend will continue also for the following months of the year,” Minelli said.

The executive noted that the Asia Pacific area, China and South Korea, in particular, are strong contributors to the group’s sales and that Japan, a market that is “historically very important” for OTB, is growing double digits despite the unfavorable currency exchange rates currently.

Leveraging the strength of the group’s brands, Minelli expressed his confidence OTB can achieve “the ambitious growth path mapped out in its strategic plan” — aiming to reach sales of 2.7 billion euros in 2025 by growing organically. Last year, turnover, including royalties, totaled 1.74 billion euros. The group, which is controlled by Renzo Rosso, is eyeing an initial public offering in 2024 or 2025.

Ferragamo, led by CEO Marco Gobbetti, is going through a period of transition under creative director Maximilian Davis and a new store concept will be unveiled in Ferragamo’s women’s boutique in Via Montenapoleone in Milan in the first quarter of 2024. The company so far has focused on touch-ups and refreshments, introducing a new logo and a dégradé red color.

Etro’s CEO Fabrizio Cardinali said that while the “most important goal is to consolidate the existing retail network,” the company has been investing in recent store openings in Cannes; Monte Carlo; Riyadh, Saudi Arabia, and Nanchang, China, and soon we will add new locations in the U.S., Japan, Dubai, China and Cambodia.

“We are cementing our identity as a lifestyle brand even further through compelling and thoughtful collaborations we have planned to begin from the end of this year,” Cardinali said.

These follow the launch of the new eyewear and childrenwear licenses, with Safilo and Simonetta, respectively.

“The women’s leather goods segment is giving us great satisfaction and we plan to continue on this path by increasingly enriching the offer of our accessory collections,” said Cardinali, adding that Etro, under the lead of creative director Marco De Vincenzo, is seeing a strong performance in Europe and good business growth in Japan, while “the results in the U.S. and China are softer due to the well-known macroeconomic headwinds.”

According to the Camera della Moda Fashion Economic Trends, chairman Carlo Capasa said sales of the fashion and linked industries (including textiles, clothing, leather goods, footwear, jewelry, eyewear and cosmetics) are expected to grow 4.5 percent in 2023 to 103.3 billion euros compared to last year.

The prudent forecast for the current year is due to a slowdown registered in the second quarter, when sales grew only 3 percent after a strong first three months, which saw an 11.4 percent increase.

In the first five months of 2023, exports continued to be a key driver for the industry, increasing 6.5 percent in the core sectors — textiles, clothing, leather goods and footwear — and 15 percent in the jewelry, eyewear and cosmetics categories, compared to the same period last year.

These were followed by exports to the U.S. and China, which grew 2.8 percent and 18.4 percent respectively.

According to projections, exports of the overall sector are expected to grow 6 percent to 91.5 billion euros in 2023, compared to last year.

Aeffe executive chairman Massimo Ferretti is “approaching this season with great enthusiasm, convinced that the strategies we have put in place over the past few months will bring rewards.”

Ferretti pointed to a significant recovery of the Chinese market and at the same time growth in the group’s direct retail channel, both brick-and-mortar and digital. “We also believe in the U.S. market where we see a notable increase in sales online and where our historical partner Saks Fifth Avenue has decided to return to invest in a significant way also on the Philosophy di Lorenzo Serafini and Pollini brands, as Alberta Ferretti and Moschino are already available there.”

Ferretti noted that this edition of fashion week is especially significant for the group because it will celebrate the 40th anniversary of Moschino with a special show on Thursday of collections designed by stylists Carlyne Cerf de Dudzeele, Katie Grand, Gabriella Karefa-Johnson and Lucia Liu — who will express their vision of the brand.

“I think this is in line with the authentic spirit of the brand and its founder. I think that Franco, an exceptional man and designer that has left a unique vision in the fashion world, would have loved this mix of styles so contemporary and innovative,” Ferretti said.

His sister, designer Alberta Ferretti, has chosen a symbol of Milan, the medieval Sforzesco Castle, for her show on Wednesday and Pollini will conclude the celebrations of its 70th anniversary with an event at the Portrait Hotel on Friday. Ferretti said an Instagram contest to win the chance to attend the Philosophy di Lorenzo Serafini that same morning was “very successful.”

Coinciding with the debut of Milan Fashion Week, Aeffe said it will go fur-free and stop purchasing angora beginning with the spring 2024 collection. “For years our company has reduced to a minimum if not practically eliminated the purchase and use of fur, but we considered it absolutely appropriate to formalize this commitment, which affects all our brands,” Massimo Ferretti said.

Missoni’s CEO Livio Proli estimated 10 percent growth in sales for 2023 compared with the previous year, based on the sell-out of the spring 2023 collection, which showed double-digit growth in the brand’s directly operated stores and online. By the end of the year, Missoni will inaugurate a new boutique in Sydney and a new flagship in Milan’s Via Verri in Milano. A new store in Las Vegas will open soon, said Proli, reflecting brisk business in the U.S. for the brand.

“At the same time, we are initiating the restructuring of our distribution in [South] Korea and Japan after ending the contracts with our historical partners,” the CEO said.

Missoni is also further expanding its interior design projects. Earlier this month, it partnered with Gafisa for the launch of an exclusive residential project in São Paulo after revealing it will create interiors for the luxury Marea residential project in the south of Spain, near Marbella, with real estate developer Dar Global.

Sergio Azzolari, CEO of Roberto Cavalli, said he expects “a relevant growth of more than 40 percent” in 2023, supported especially by the brand’s directly operated stores and its online store. Last year the retail development began with openings in Miami, Rome and Montecarlo and is continuing with a new boutique in London’s Bond Street and one in Las Vegas at Encore at Wynn. Cavalli is taking direct control of the boutique in Manama (Barhein) and in Riyadh.

Azzolari touted the strong performance of the “Wild Leda” capsule collection designed by Fausto Puglisi that launched last summer, with a tour that kicked off at Selfridges and traveled through pop-ups in boutiques in Milan, Rome, Miami, London, Saint-Tropez, Cannes and Porto Cervo. In addition, events and pop-ups were staged at LuisaViaRoma, Michele Franzese Moda in Naples and Julian Fashion at beachside resort Milano Marittima.

“The project has been a success and generated excellent results both in terms of brand visibility, as well as strengthening our relation with our clients, setting the foundations for other future projects,” Azzolari said.

As part of a relaunch of its accessories, during Milan Fashion Week a new campaign fronted by Mariacarla Boscono to highlight Cavalli’s Roar bag will be featured on several trams in the city.

Best of WWD